If you can, however, a loan from us could tide you in excess of Whilst you can’t make ends satisfy. Unexpected emergency payday loans don't have any precise objective with regards to how they’re used. Even so, borrowers usually need to have crisis loans for rapid charges like the next:

Picture: Man sitting down on couch wearing headphones, considering what credit history score he ought to get a personal loan

A free coaching method for Girls and Group workers in NSW to acquire funds management competencies, information and confidence.

A number of other individual loan providers and money establishments will convert absent individuals with very poor credit score, but OppLoans features options for anyone who has undesirable credit score standing.

Actually, payment record accounts for 35% of your FICO score. However, missing payments or defaulting over a loan can negatively effect your score. To help with this, several lenders present an autopay option that means that you can routine payments.

The Cashfloat Quick Commence aspect lets you lower your to start with instalment and offers you an extra month to repay your loan at no supplemental cost

Join to acquire the inside scoop on today’s biggest stories in markets, tech, and business — shipped everyday. Read preview

Keep in mind: having out a loan you may’t afford to repay could potentially cause you critical fiscal challenges. Even within an crisis, keep accountable and only borrow the amount you'll 57 loan need.

Why an Earnin loan stands out: If You simply need to have a little amount of cash, Earnin could be a superb match as it enables you to advance small amounts from an approaching paycheck. In keeping with Earnin, you could potentially get your cash virtually quickly if you’re a previous buyer and fulfill sure eligibility necessities.

Having said that, your goal should not be to get the most favorable phrases but to find a lender that provides a loan you'll be able to qualify for. Here's the very best lenders to select from.

Most lenders will acknowledge a DTI ratio of forty three% or fewer. On the other hand, it’s useful to understand how distinctive ranges can effect your probability of approval when implementing for a house loan.

There’s no single list of demands for typical loans. The DTI eligibility need usually depends on a borrower's finances, credit record and loan variety.

DTI more than fifty%: A DTI ratio of 50% or higher implies a significant amount of debt and signals which the borrower might be not economically wanting to repay a home finance loan. Lenders normally deny borrower programs if the DTI ratio is this significant.

The compensation we receive from advertisers will not affect the tips or tips our editorial group provides inside our article content or normally influence any with the editorial content on Forbes Advisor. While we work hard to offer correct and up to date data that we expect you'll find related, Forbes Advisor doesn't and cannot promise that any information and facts presented is complete and can make no representations or warranties in link thereto, nor for the accuracy or applicability thereof. Here's an index of our associates who offer items that We've affiliate one-way links for. lorem

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Matilda Ledger Then & Now!

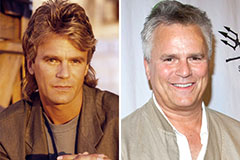

Matilda Ledger Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!